Michigan Charitable Gaming Commission

Frequently Asked Questions

The next regular meeting of the Mississippi Gaming Commission will be held on Thursday, March 18, 2021 beginning at 9:00 a.m. At the Jackson Office of the Mississippi Gaming Commission, 620 North Street, Suite 200, Jackson, MS 39202. The first session will be held for the purpose of discussing gaming.

Collaborate with legislators, the Charitable Gaming Division of the Michigan Lottery, and the Michigan Gaming Control Board on legislation that impacts charitable gaming activities. Educate the public and non-profit organizations engaged in charitable fundraising under the Traxler-McCauley-Law-Bowman Bingo Act 382 of 1972. Event Date(s): The date provided does not match any records for this organization. In order to check the status of your raffle or special bingo license application, you will need to know and enter the following: Your 6-digit organization ID that we assigned you. The date of your event.

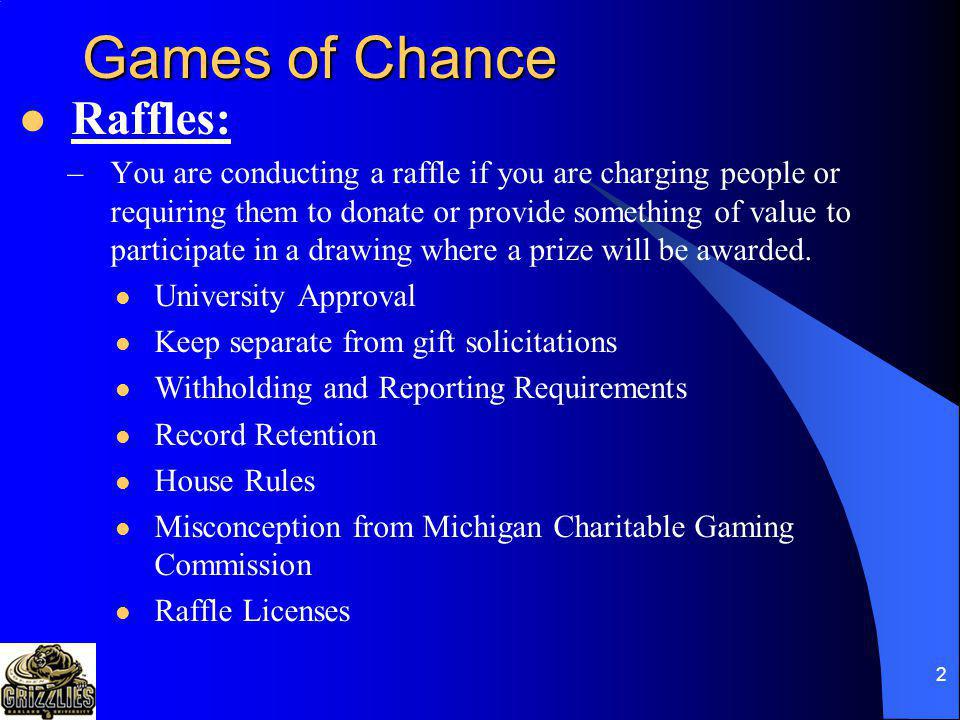

What is the difference between the Charitable Gaming Division of the Michigan Lottery, the Michigan Gaming Control Board, and the Michigan Charitable Gaming Association (MiCGA)?- Charitable Gaming is a division of the Michigan Lottery, which is a bureau of the State of Michigan. Charitable Gaming is responsible for the licensing, oversight, and regulation of bingo, raffles, and charity game tickets in the State of Michigan.

- The Michigan Gaming Control Board is supported by the Attorney General's Office - Alcohol and Gambling Enforcement Division, the Michigan State Police Gaming Section, and the Department of Technology, Management and Budget. The Michigan Gaming Control Board is responsible for the licensing, oversight and regulation of millionaire parties in the State of Michigan.

- MiCGA is a not-for-profit membership trade association incorporated under the laws of the State of Michigan and governed by a Board of Directors. MiCGA does not handle the licensing requests of charitable organizations or suppliers.

What does MiCGA do?

- Help charities better understand the application and licensing processes for charitable fundraising as imposed by the Traxler-MCauley-Bowman Bingo Act 382 of 1972. This act regulates the conduct of charitable gaming, including bingo, millionaire parties, raffles, and charity game tickets.

- Educate the public and non-profit organizations engaged in charitable fundraising under the Traxler-MCauley-Bowman Bingo Act 382 of 1972.

- Work to maintain the long-term stability of charitable fundraising in Michigan and to improve conditions for charities and other organizations engaged in this type of charitable fundraising.

- Serve as a spokesperson for its members at the local, state, and federal level.

- Provide the membership with information on regulatory and legislative matters.

- Assist charities and room operators with mitigating issues that may arise.

- No, you do not have to be a member of MiCGA in order to be licensed by the State of Michigan and hold a millionaire party, bingo game or raffle at an approved location for the purpose of raising funds. However, MiCGA exists to give your charity a voice and there is strength in numbers – the more voices that are heard, the more of an impact we will have on those formulating the laws, rules, and regulations that directly affect the charitable gaming industry.

Michigan Charitable Gaming Commission 2020

What types of Membership levels are available and what is the cost?- (i) Charities ($300 annual fee): non-profit organizations recognized by the IRS who have an interest in charitable gaming and are eligible to receive a charitable gaming license under Michigan Law.

- (ii) Room Operators ($300 annual fee): those supplying materials specific to the charitable gaming industry as used in charitable gaming and licensed by the State of Michigan as a Supplier or those who own a location where licensed charitable gaming events take place pursuant to state approved contracts.

Many states have enacted laws exempting certain charitable gaming activities from the applicable anti-gambling laws.

Websites containing state statutes are available for all states, although they may be out of date. The excerpts presented here are taken from those websites. It may take a long time before new provisions of a state law are incorporated into the online text the state makes available. Before acting on any information contained in RealGamblingUSA.com you should get up to date and to the point advice from a lawyer.

The most commonly exempted activities are bingo and charitable raffles as well as certain types of casino games. Hawaii and Utah do not have any charitable gaming laws.

The charitable gaming laws from all states that have them are listed in the table below. To view the applicable state law click on the name of the state.